Management team and Board of proven mine builders with a strong global track record of creating shareholder value.

Over 2M Oz of 43-101 Current Resources and growing.

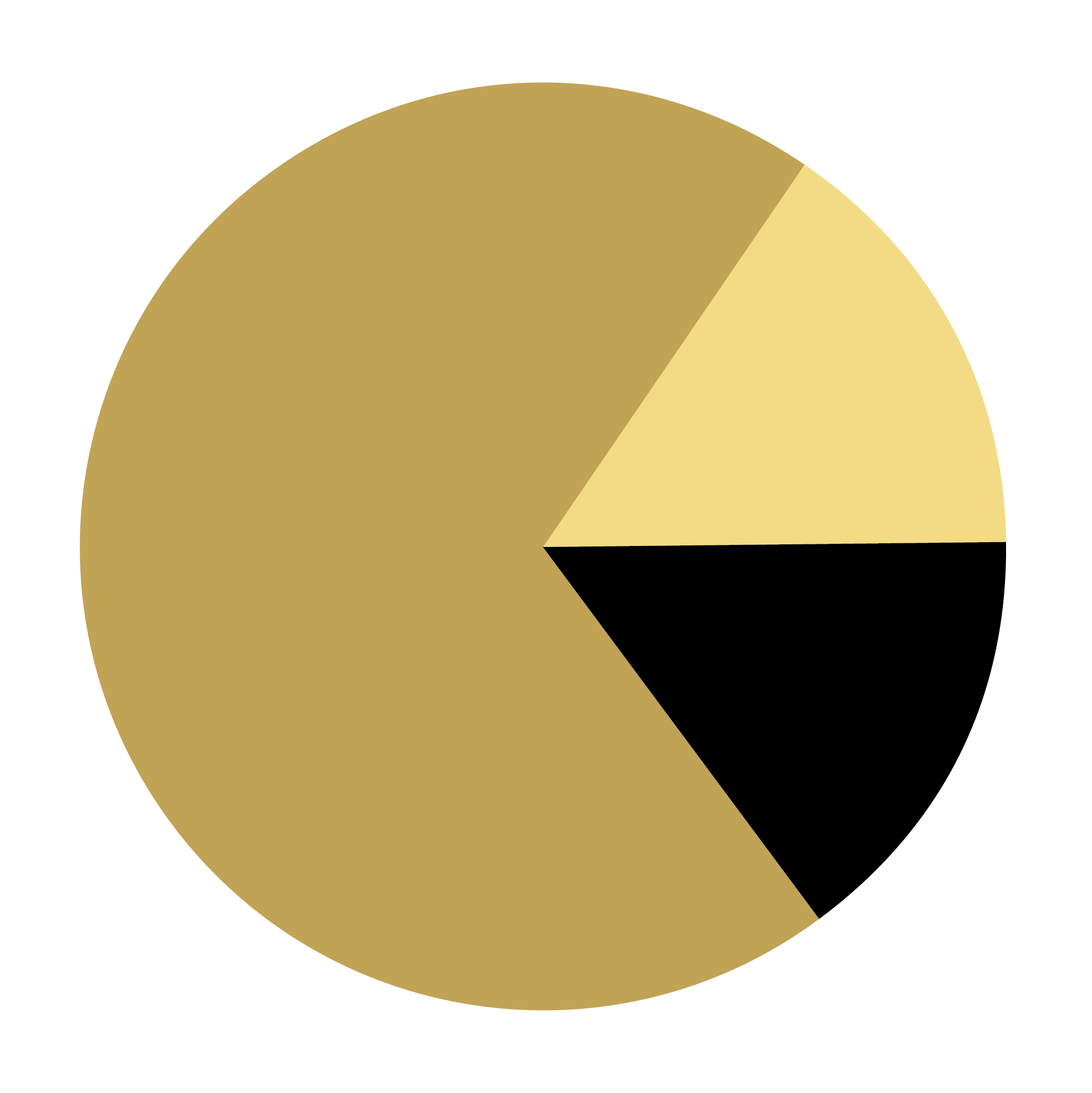

2025 PEA valuation shows strong value in situ with $534M NPV at $2650/oz Au and over $1.2B NPV at $3700/oz Au.

Compelling upside and valuation

Drilling is underway to Expand Resources, Advance and De-risk the Project towards a PFS.